Astute to Use Competitive Bid for T-bills?

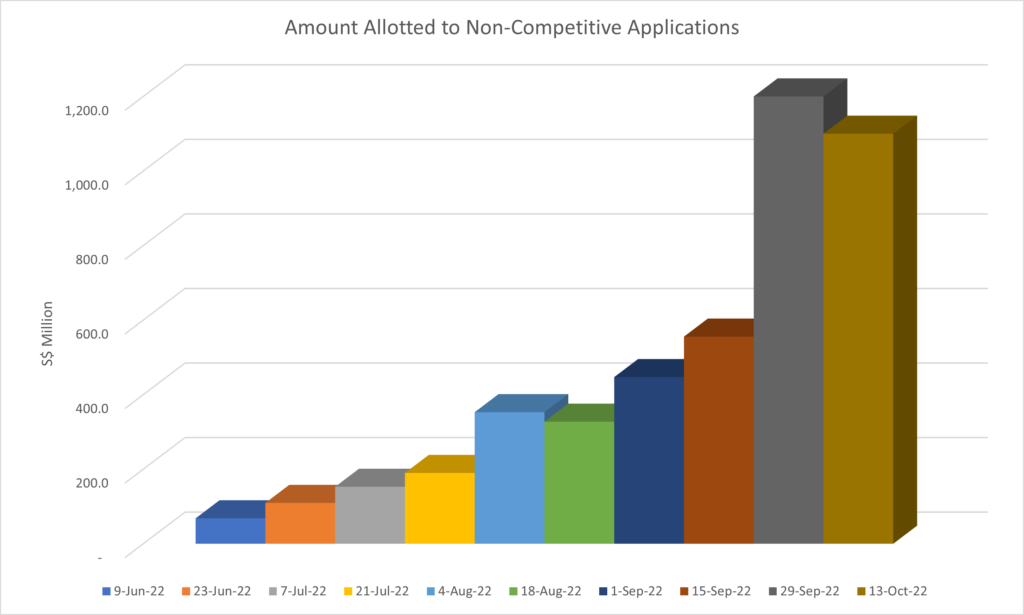

T-bills are all the rage now as short-term rates continue to rise. However, there is a trend that may have gone unnoticed. The percentage of amount allotted to non-competitive applications out of total amount allotted has been going up significantly over the past few auctions. As a maximum of 40% of the issuance size will be allotted to non-competitive bids, if the total amount of non-competitive bids exceed this limit, the allotment will be on a pro-rated basis. This means that a non-competitive bid may result in a less than satisfactory amount allotted!

I suspect that most of the non-competitive bids are placed by individual investors, so higher demand for T-bills by this group as yields climb is resulting in a higher percentage of non-competitive applications out of total applications.

Therefore, I think it is astute to use a competitive bid if one wants to be sure of a full allotment. I would consider the yield of my “next best alternative” to the T-bill, which is usually a high yield savings account or a 6 month fixed deposit, and set a T-bill competitive bid around that yield. If the cut-off yield ends up higher than your competitive bid, you get full allocation and at the “higher” cut-off yield. You can refer to the section on “Competitive or Non-Competitive Bid” in my earlier post to learn more.

Step-by-Step Guide to Apply Using Competitive Bid

Below is a step-by-step guide for users of DBS internet banking on how to apply for T-bill using a competitive bid.

Summary

Non-competitive bid have been working fine so far, but with T-bill demand going up, there is no harm in setting a competitive bid at your desired level (and preferably not too high to ensure full allotment). Take note that the next 6-Month T-bill auction will be held on 27 Oct 2022, so applications have to be sent to the banks by 26 Oct 2022. Coincidentally, the 3.21% Nov SSB also closes on this date. This Nov SSB is another good option for good Singapore investors due to the “flexibility for free upgrade”, though take note of the potential for lower than wished allotment.