2023 SGS Issuance Calendar Freshly Released!

The 2023 SGS Issuance Calendar has just been released on the MAS website. Here are some of the key takeaways to note for next year.

Fortnightly 6-Month T-bill and Quarterly 1-Year T-bill

MAS has kept the 2023 T-bills issuance frequency similar to 2022. 6-Month T-bills will be issued every fortnight (total 25 issues in 2023) and 1-Year T-bills will be issued every quarter. I was hoping for more frequent 1-Year T-bill issuances so that I can try to lock in yields for a longer period next year (when interest rates are peak).

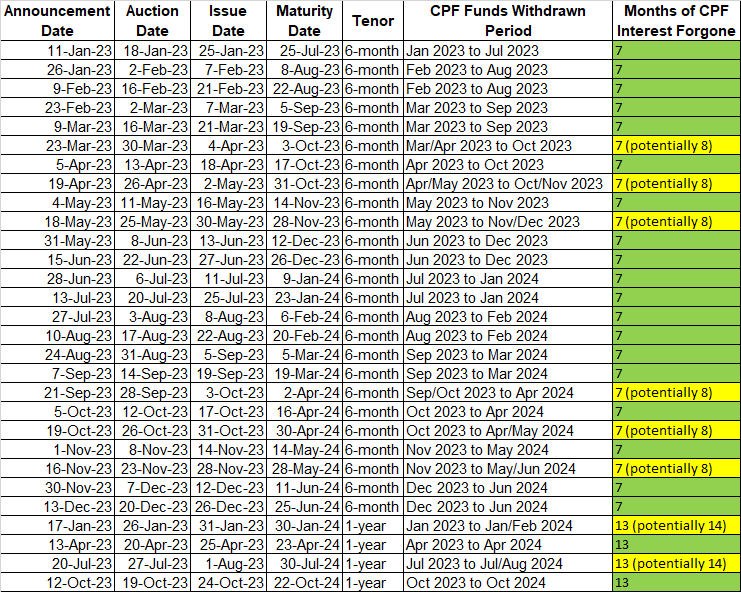

For those looking to use CPF OA funds to purchase T-bills, I have created a table showing the estimated number of months of CPF interest forgone. I will avoid issues with issue date and maturity date near the start / end of the month. The actual deduction from CPF OA takes place after the auction date and before the issue date. You can refer to my earlier post to learn more.

SGS Bonds

There are only 9 SGS Bonds issuances in 2023, 8 of which are “Reopen” and only 1 “New”. The only interesting ones for me are the 2-year SGS Bonds as I do not fancy those with a long tenor (and thus high interest rate risk, in case interest rate rise even further). The 2-year SGS Bonds auction dates are on 24-Feb-2023 and 29-Aug-2023. In addition, the 2-year SGS Bonds is ideal if you are looking to use CPF OA funds, as your opportunity cost of forgone interest will be spread over a longer period and you get to lock in the high yield for a decent 24 months.

Singapore Savings Bonds

There is nothing unexpected for Singapore Savings Bonds issuance. There will be one issue every month, with the announcement date on the first working day of the month and the closing date around the end of the month.

Amount Offered

The amount offered for each issue will only known on the announcement date. The average amount offered for 6-Month T-bills so far this year was S$4.3 billion and that for 1-Year T-bills was $3.6 billion. Government borrowings from SGS cannot be used to fund expenditures. Under the Government Securities Act (enacted in 1992), the monies raised from SGS cannot be spent. Therefore, I expect the 2023 auction amount to be similar to 2022.

Plan

Do you plan to subscribe to T-bills or SGS Bonds or Singapore Savings Bonds in 2023? Even banks fixed deposit and high yield savings account rates are getting more attractive now, so we are really spoilt for choice!